Financial statement analysis involves comparing financial ratios, but differences in accounting methods can make comparisons difficult however, it is important for business owners and managers to also consider factors beyond financial statements and ratios, such as changes in technology and industry trends.💡 Understanding and analyzing financial statements and ratios is critical, but it's important to look beyond them to fully understand a company's makeup, consumer tastes, and economic factors.įinancial statement analysis involves comparing ratios, but it's important to consider factors beyond financial statements analyzing changes in dollar and percentage terms can highlight economically significant and unusual changes, such as the 9% decrease in cash.

📈 Business owners and managers should not solely rely on financial statements and ratios, but also consider factors like changes in technology, industry trends, and internal company changes for a comprehensive understanding of the business.Importance of considering non-financial factors 💰 "Our total assets are up overall, indicating potential growth and success for the company.".📈 "As we sell more, we would expect our gross margin to go up, but by how much should it go up so that again we'll have to examine our trend analysis a little bit more to see how we're doing there.".📈 The 150% increase in prepaid expenses is intriguing and prompts curiosity about the reasons behind such a substantial rise.💲 When analyzing financial statements, it is important to consider both dollar and percentage changes over time to understand the economic significance of the changes.

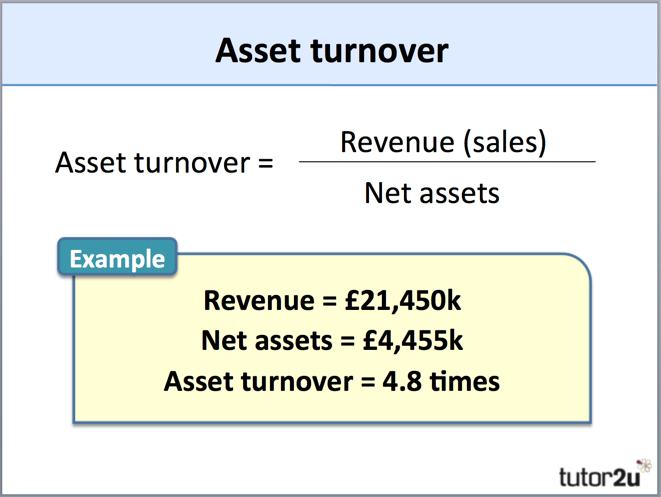

📊 The accounts receivable turnover ratio of 26.7 times indicates that Norton Corporation sells and collects payment approximately 26.7 times in a year, which should be compared to previous years to determine if it is good or bad.📊 It is important to compare current ratios over multiple years, preferably a minimum of three years, to determine the direction of the company's financial health.

0 kommentar(er)

0 kommentar(er)